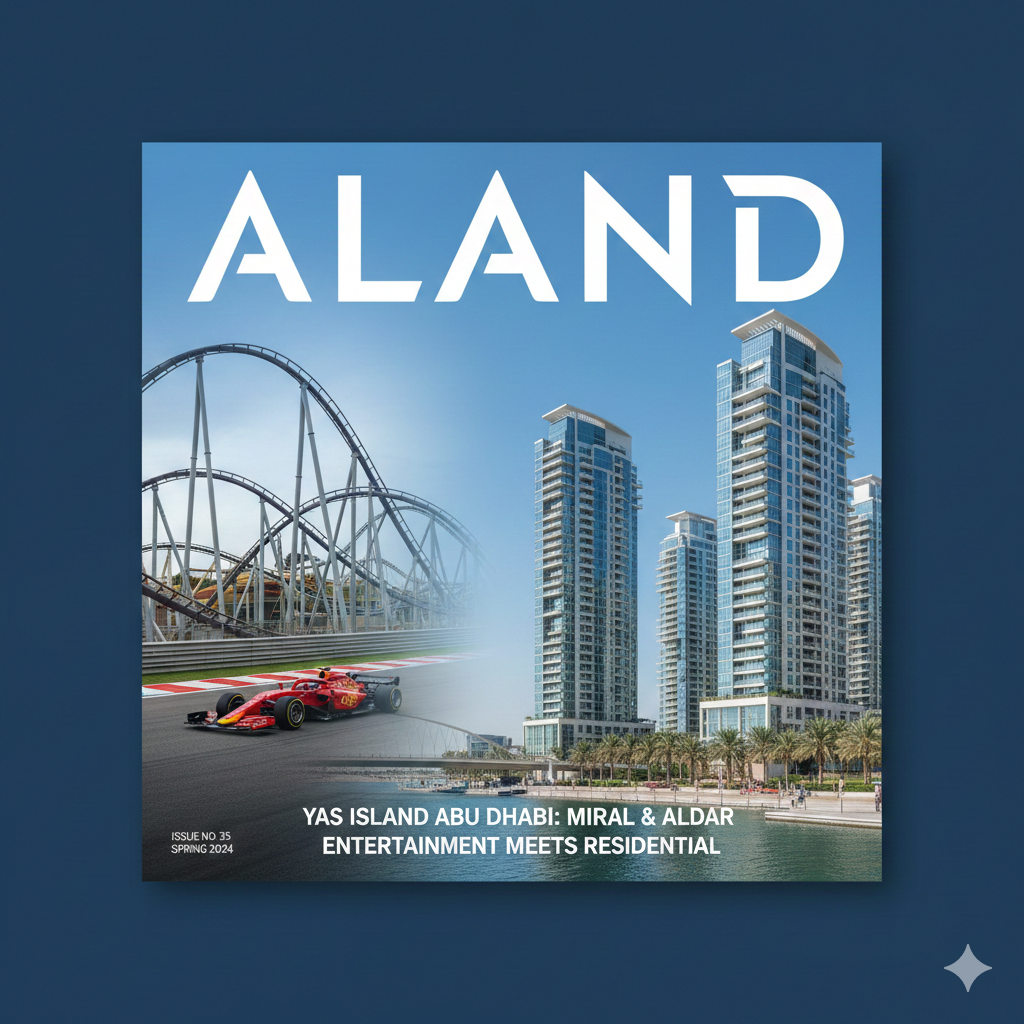

Yas Island Abu Dhabi: Miral and Aldar - Entertainment Meets Residential

- Published Date: 25th Dec, 2025

-

4.9★ ★ ★ ★ ★(114)

By Dr. Pooyan Ghamari

Executive Summary

Yas Island in Abu Dhabi has solidified its position as the emirate's premier leisure and residential destination, seamlessly blending world-class entertainment with upscale living through the collaborative efforts of Miral Asset Management and Aldar Properties. Miral drives the island's iconic attractions – including Yas Marina Circuit (home to the Formula 1 Etihad Airways Abu Dhabi Grand Prix), Ferrari World Abu Dhabi, Warner Bros. World, Yas Waterworld, and SeaWorld Abu Dhabi – while Aldar develops premium residential communities like Yas Acres, Yas Bay Waterfront, and Mayan. As of December 2025, Yas Island continues to evolve with new launches such as Aldar's Lea and ongoing enhancements to entertainment offerings, drawing high tourism and residential demand.

Market performance reflects strong fundamentals, with apartment prices appreciating steadily and villa segments commanding premiums for golf or waterfront views, supported by yields of 6-8%. The island's strategic location – 20 minutes from Abu Dhabi city center and 45 minutes from Dubai – combined with direct airport proximity enhances accessibility. For residents, living here means exclusive access to theme parks, beaches, marinas, and events, creating a resort-like lifestyle. Investors benefit from tourism-driven short-term rentals and long-term appreciation in this maturing entertainment-residential hub.

Company and Market Background

Miral Asset Management, established in 2012 as an Abu Dhabi government-backed entity, focuses on creating and managing destination experiences, transforming Yas Island into a global leisure powerhouse with investments exceeding AED 20 billion. Key assets include the theme parks, Yas Marina, Clymb adventure facility, and Yas Links golf course. Aldar Properties, Abu Dhabi's leading listed developer since 2005, partners on residential components, delivering communities like Yas Acres (villas and townhouses), Water's Edge (apartments), and Yas Bay (mixed-use waterfront with residences).

Recent collaborations include Aldar's developments overlooking attractions, ensuring residents enjoy proximity perks. In 2025, expansions feature new retail, dining at Yas Bay, and residential phases aligning with tourism growth.

Abu Dhabi's market in late 2025 shows resilience in prime leisure-linked areas, with Yas Island benefiting from record visitor numbers post-Grand Prix and theme park milestones. Demand from international buyers and expats drives transactions, with off-plan sales strong due to flexible plans. Yields remain competitive at 6-8%, bolstered by short-term rental viability during events. Overall, the Miral-Aldar synergy positions Yas Island as Abu Dhabi's entertainment capital with robust residential value.

Detailed Analysis

The partnership between Miral and Aldar exemplifies integrated placemaking, where entertainment anchors elevate residential appeal on Yas Island. Miral's attractions form the vibrant core – Ferrari World with record-breaking rides, Warner Bros. indoor theme park, and SeaWorld's marine experiences – drawing millions annually. Aldar's residences integrate seamlessly, offering views of circuits, parks, or marinas with amenities like private beaches, golf access, and concierge services linking to attractions.

Projects vary: Yas Acres emphasizes low-density villas on golf courses, Yas Bay provides urban waterfront apartments, and Mayan offers mid-rise family units.

Contrasting asset classes, apartments versus villas highlight the island's diversity. Apartments, prevalent in waterfront towers like Water's Edge or Yas Bay, offer 1-3 bedroom layouts (800-2,500 square feet) with shared pools, gyms, and direct promenade access. These suit professionals or smaller households, providing low-maintenance living, event proximity, and higher yields up to 8% from tourism rentals. Prices reflect strong 2025 growth in view-oriented units.

Villas and townhouses, dominant in Yas Acres and similar enclaves, deliver 3-6 bedroom homes (3,000+ square feet) with private pools, gardens, and golf frontage. These appeal to families seeking space and exclusivity, commanding premiums for lifestyle prestige and yields around 6-7% from long-term tenants. While apartments leverage vertical convenience and income potential, villas excel in horizontal luxury and retention, often outperforming in capital appreciation amid limited supply.

This duality – dynamic accessibility versus serene expanse – strengthens Yas Island's unique entertainment-residential fusion, with Miral's attractions and Aldar's quality driving sustained demand.

Pros and Cons

Yas Island delivers an unparalleled resort-entertainment lifestyle, where daily life feels like a perpetual vacation amid world-class facilities. Residents enjoy priority access to theme parks, beaches, marinas, and events like the Grand Prix, fostering excitement rarely matched elsewhere. High-end construction, smart features, and integrated amenities promote wellness and community, ideal for families and active professionals.

Investment appeal includes tourism-boosted yields, appreciation from infrastructure, and event-driven value spikes. Connectivity supports commutes while maintaining island seclusion.

Challenges encompass seasonal crowds during major events potentially affecting tranquility, premium pricing reflecting exclusivity, and reliance on private vehicles (though shuttles and future enhancements planned). Service charges are higher for extensive facilities, and short-term rental management requires compliance. Aircraft noise from nearby airport is minimal but present for some units.

Ultimately, the extraordinary entertainment integration, lifestyle quality, and growth outweigh drawbacks for those embracing its vibrant profile.

Buyer Recommendations

Short-term yield investors should target waterfront apartments in Yas Bay or similar, capitalizing on tourism and event seasons for enhanced returns.

Family legacy buyers would thrive in villas at Yas Acres, benefiting from golf views, space, and attraction access for generational appeal.

Investor Profile 1: Tourism Yield Buyer Expats or remote investors prioritizing income. Focus on 1-2 bedroom apartments with park or marina views for rental flexibility and 7-8% yields.

Investor Profile 2: Entertainment Family Resident Affluent households valuing excitement and space. Select 4+ bedroom villas/townhouses near attractions for privacy and daily perks.

Checklist for Potential Buyers:

- Prioritize views toward parks, circuit, or waterfront.

- Review attraction access perks and event schedules.

- Analyze short- versus long-term rental data.

- Inspect communal facilities and beach proximity.

- Test commute times to Abu Dhabi/Dubai.

- Evaluate service charges against lifestyle benefits.

- Confirm Golden Visa eligibility thresholds.

- Check developer handover and quality records.

- Budget for event-season premiums.

- Visit during non-event periods for balanced feel.

ALand

ALand FZE operates under a valid Business License issued by Sharjah Publishing City Free Zone, Government of Sharjah (License No. 4204524.01). Under its licensed activities, ALand provides independent real estate consulting, commercial intermediation, and investment advisory services worldwide. Through a structured network of cooperation with licensed developers, brokers, and real estate firms in the UAE and internationally, ALand assists clients in identifying suitable opportunities, evaluating conditions, and navigating transactions in a secure and informed manner. ALand’s role is to support clients in finding the best available offers under the most appropriate conditions, using professional market analysis, verified partner connections, and transparent advisory processes designed to protect client interests and reduce execution risk. All regulated brokerage, sales, and transaction execution are carried out exclusively by the relevant licensed entities in each jurisdiction. In addition, ALand is authorized to enter consultancy and cooperation agreements with real estate corporations, developers, and professional advisory firms across multiple countries, enabling the delivery of cross-border real estate consulting and intermediation services tailored to the needs of international investors and institutions.