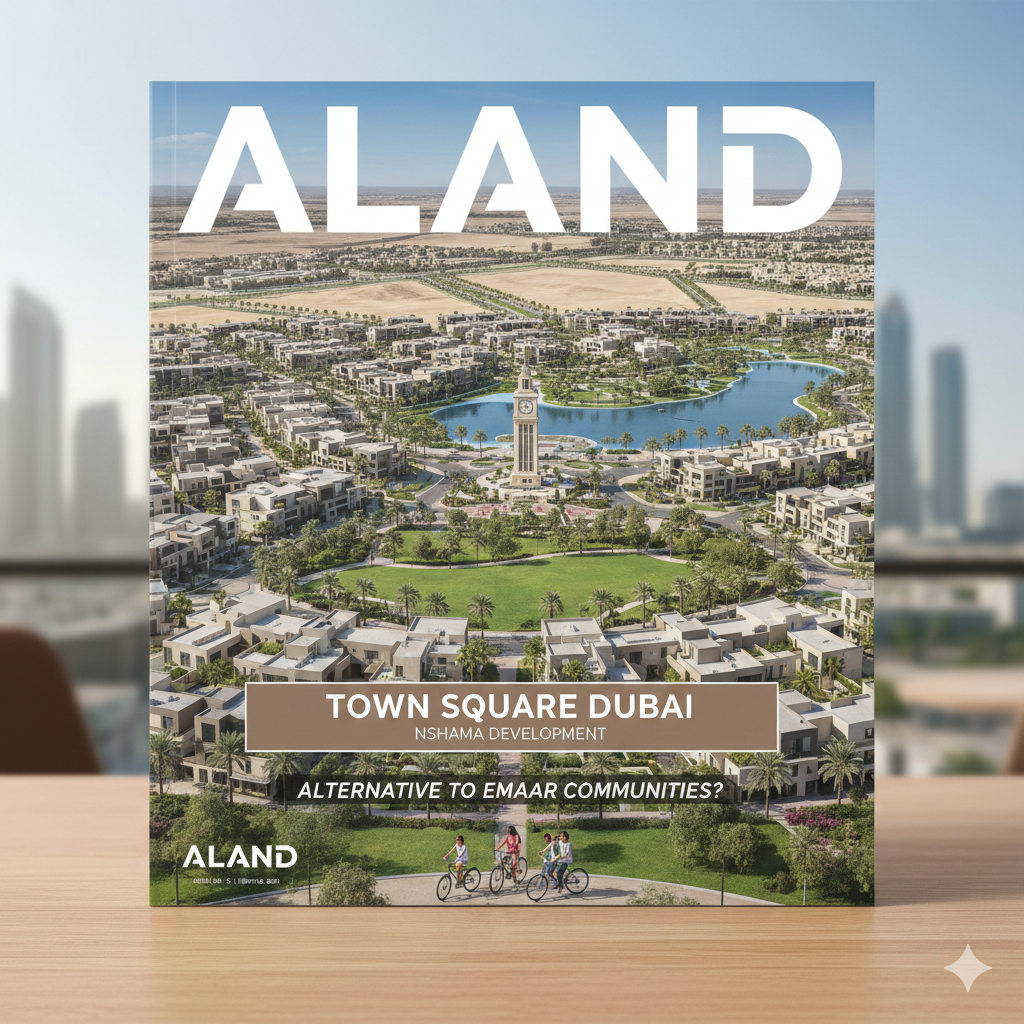

Town Square Dubai: Nshama Development - Alternative to Emaar Communities?

- Published Date: 25th Dec, 2025

-

4.8★ ★ ★ ★ ★(135)

By Dr. Pooyan Ghamari

Executive Summary

Town Square Dubai, a large-scale master-planned community developed exclusively by Nshama, has emerged as a compelling affordable alternative to premium Emaar communities like Arabian Ranches or Dubai Hills Estate in late 2025. Spanning 154,000 square meters along Al Qudra Road, this vibrant suburban enclave features modern apartments, townhouses, and limited villas centered around a massive 37,000-square-meter central park, retail avenues, pools, and sports facilities, targeting young families and professionals seeking space without premium pricing. Average apartment prices range from AED 800,000-1.8 million, townhouses from AED 1.8-3 million, delivering gross rental yields of 7-9%—often higher than Emaar equivalents—and capital appreciation of 6-10% annually, supported by rapid population growth and infrastructure upgrades.

Nshama, a subsidiary of Dubai Holding, positions Town Square as a "new urban living" concept with contemporary design, extensive green spaces, and community-focused amenities like Reel Cinemas, skate parks, and cycling tracks. Compared to Emaar's higher-end finishes and prestige pricing, Nshama offers excellent value through spacious layouts, flexible payments, and lower service charges, though with slightly more modest materials and longer-term maturation. For buyers in 2025-2026, Town Square serves as a strong alternative for those prioritizing affordability, family amenities, and yield over iconic branding, with best opportunities in ready or near-completion phases like Zahra, Hayat, and Rawda apartments.

Company and Market Background

Town Square Dubai was launched by Nshama in 2015 as an ambitious self-contained community emphasizing affordable modern living. Nshama, established in 2014 as a private real estate arm focused on mid-market segments, has delivered multiple phases including Zahra Apartments (early handovers), Hayat Townhouses, Rawda Apartments (green-inspired), Naseem Townhouses, and ongoing projects like Jenna Apartments and Warda. The community includes Town Square Park (Dubai's largest private park in a residential development), retail strips, Carrefour hypermarket, and Vida Town Square hotel.

In 2025, Dubai's suburban market favors value-driven communities amid moderated luxury growth, with Town Square benefiting from proximity to Al Maktoum Airport, Expo City, and upcoming metro extensions. Nshama's focus on timely delivery and resident-centric planning has built strong occupancy, contrasting Emaar's premium positioning in communities like Arabian Ranches (equestrian theme) or Dubai Hills (golf-centric luxury).

Detailed Analysis

Town Square's portfolio centers on mid-rise apartments (1-3 bedrooms) and low-rise townhouses (3-4 bedrooms), with views of central park, boulevards, or internal courtyards.

Contrasting apartments versus townhouses highlights alternatives to Emaar. Apartments in Zahra, Rawda, or Jenna phases offer spacious modern layouts with shared pools, gyms, and park access, priced from AED 800,000, appealing to young families or investors for high yields. Nshama emphasizes open-plan designs and smart features, comparable to Emaar's mid-range but at 30-40% lower cost.

Townhouses in Hayat or Naseem provide private gardens, covered parking, and maid rooms, rivaling Emaar's Mira or Reem townhouses in space but with more affordable entry and lower charges. While Emaar offers superior finishes and branding, Nshama delivers practical quality with extensive amenities like trampoline parks and splash pads, suiting active families. Overall, Town Square matches Emaar in livability at reduced pricing.

Pros and Cons (vs Emaar Communities)

Town Square's advantages over Emaar include significantly lower entry prices (30-50% less for similar sizes), higher yields from affordability-driven demand, and extensive central park/recreational facilities rivaling Dubai Hills. Nshama's flexible payments and timely handovers appeal to first-time buyers, with vibrant community events fostering belonging.

Compared to Emaar, drawbacks involve slightly more modest finishes (e.g., standard vs premium materials), longer distance from central Dubai (30-45 minutes vs Emaar's closer suburbs), and emerging prestige versus Emaar's established branding. Service charges are lower, but some residents note slower maintenance response in high-volume phases.

Overall, Town Square excels as a value alternative for practical family living.

Buyer Recommendations

For families seeking Emaar-like space affordably, Nshama townhouses in Hayat or Naseem.

Yield investors suit Rawda or Zahra apartments.

Checklist:

- Prioritize park or boulevard views.

- Choose ready phases for immediate occupancy.

- Compare townhouse privacy vs apartment amenities.

- Evaluate Nshama handover records.

- Project yields net of charges.

- Visit central park for lifestyle fit.

- Check school/retail proximity.

- Consider Golden Visa thresholds.

- Diversify unit types.

- Use specialists vs Emaar comparisons.

ALand

ALand FZE operates under a valid Business License issued by Sharjah Publishing City Free Zone, Government of Sharjah (License No. 4204524.01).

Under its licensed activities, ALand provides independent real estate consulting, commercial intermediation, and investment advisory services worldwide. Through a structured network of cooperation with licensed developers, brokers, and real estate firms in the UAE and internationally, ALand assists clients in identifying suitable opportunities, evaluating conditions, and navigating transactions in a secure and informed manner.

ALand’s role is to support clients in finding the best available offers under the most appropriate conditions, using professional market analysis, verified partner connections, and transparent advisory processes designed to protect client interests and reduce execution risk. All regulated brokerage, sales, and transaction execution are carried out exclusively by the relevant licensed entities in each jurisdiction.

In addition, ALand is authorized to enter consultancy and cooperation agreements with real estate corporations, developers, and professional advisory firms across multiple countries, enabling the delivery of cross-border real estate consulting and intermediation services tailored to the needs of international investors and institutions.