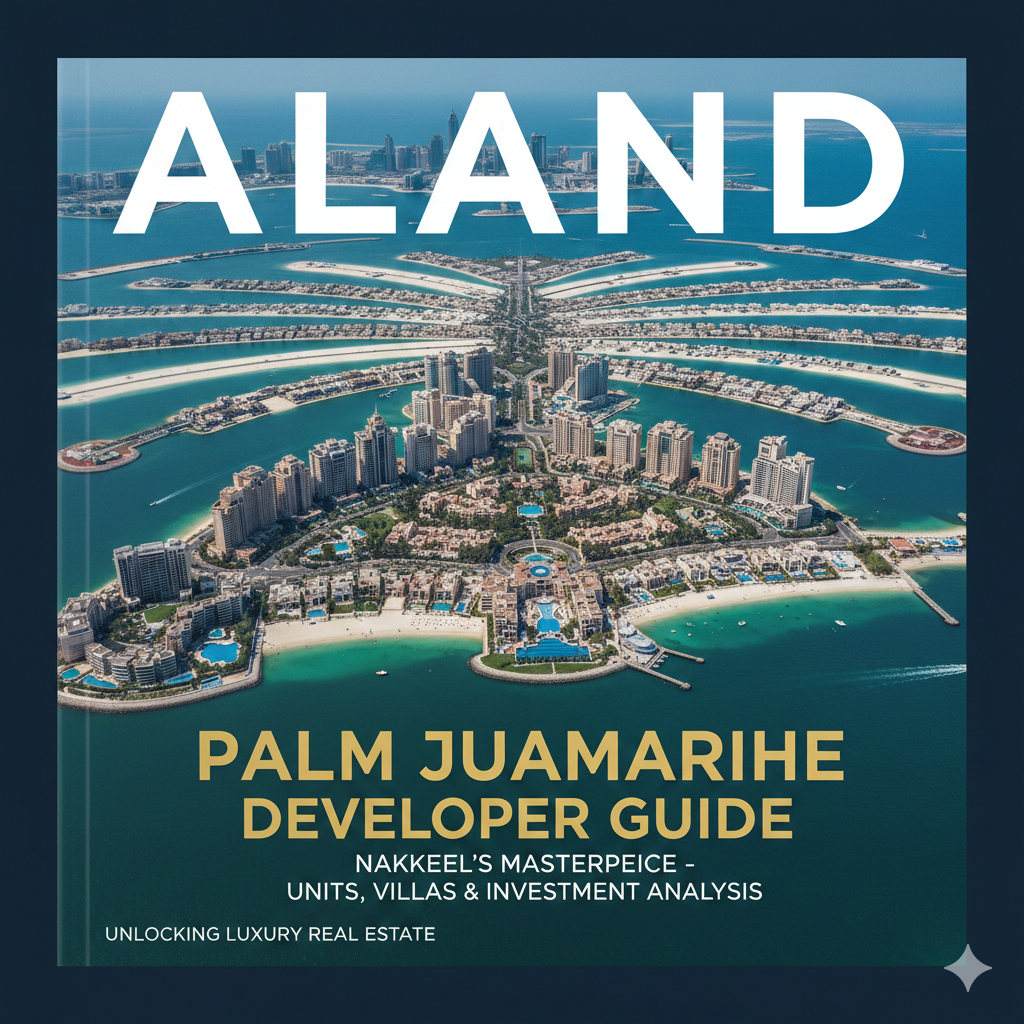

Palm Jumeirah Developer Guide: Nakheel’s Masterpiece - Units, Villas & Investment Analysis

- Published Date: 25th Dec, 2025

-

4.8★ ★ ★ ★ ★(96)

By Dr. Pooyan Ghamari

Executive Summary

Palm Jumeirah, Nakheel’s iconic man-made island shaped like a palm tree, remains one of Dubai’s most recognizable and prestigious addresses in late 2025. Completed in phases over two decades, the development features 16 fronds with luxury villas, trunk apartments, and beachfront hotels and residences along the 5-kilometer crescent. Average apartment prices range from AED 2,500-3,500 per square foot, while beachfront villas command AED 20-100 million depending on size and plot, delivering gross rental yields of 5-7% for apartments and 4-6% for villas, supported by strong tourism and expatriate demand. Capital appreciation has been solid at 8-12% annually in recent years, with prime beachfront assets outperforming.

Nakheel dominates as master developer, responsible for infrastructure and most original projects, while secondary developers such as Emaar (limited branded residences), DAMAC, and Select Group contribute select luxury towers on trunk or crescent plots. Signature residences like Atlantis The Royal and upcoming Palm 360 add ultra-luxury inventory. For 2025-2026, best opportunities lie in ready beachfront villas for lifestyle and legacy value, and selective trunk apartments for yield, as the island’s maturity and limited new supply enhance scarcity-driven growth.

Company and Market Background

Palm Jumeirah was launched by Nakheel in 2001 as the first of three planned palm islands, with land reclamation completed by 2006 and full infrastructure maturation over subsequent years. Nakheel developed the core residential stock, including frond villas, Garden Homes, Signature Villas, and trunk apartment clusters like The Fairways and Shoreline. Over time, select plots were allocated to reputable partners, leading to branded developments such as Emaar’s Anantara Residences, DAMAC’s Cavalli-branded options, and ultra-luxury projects like Raffles The Palm by Emerald Palace Group.

In 2025, Dubai’s luxury waterfront market sustains robust performance driven by tourism recovery, Golden Visa enhancements, and high-net-worth inflows. Palm Jumeirah benefits from its irreplaceable status and global brand recognition, with strong short- and long-term rental demand from tourists, executives, and families. Connectivity via monorail, trunk road, and upcoming expansions supports accessibility, while the island’s maturity ensures established amenities including Nakheel Mall, Club Vista Mare, and numerous beach clubs.

Detailed Analysis

Palm Jumeirah offers diverse residential classes: beachfront villas on fronds with private pools and direct sea access; Garden and Signature Villas slightly inland on larger plots; trunk high-rise apartments in clusters; and crescent or select trunk branded hotel-residences. Views range from full Atlantic Ocean to partial Gulf or internal lagoon.

To provide contrast, examine beachfront frond villas versus trunk high-rise apartments. Beachfront villas, primarily Nakheel’s original Signature and Canal Cove series or custom homes on larger plots, deliver exclusive island living with private beaches, expansive gardens, and panoramic sea views, attracting ultra-high-net-worth families and legacy buyers. These command the highest premiums due to absolute scarcity (only ~4,000 villas total) and lifestyle prestige, offering resilient appreciation as infrastructure maturation and tourism growth enhance desirability. Rental performance often combines long-term leases with high-season short-term upside.

In comparison, trunk apartments in Nakheel’s Shoreline, Golden Mile, or partner developments provide more accessible entry with shared amenities, gyms, and pools, appealing to professionals and investors seeking yield. These achieve higher gross returns from broader tenant pools and lower maintenance, with quicker liquidity in secondary markets. While lacking private beach access, they benefit from proximity to Nakheel Mall and monorail, making them more income-focused. Nakheel’s overarching master planning ensures quality across classes, while partner branded towers add premium differentiation.

Pros and Cons

Palm Jumeirah’s primary strengths include unmatched prestige and beachfront scarcity, with direct sea access, private beaches, and iconic views fostering exceptional lifestyle appeal and tenant retention. Nakheel’s proven delivery and ongoing infrastructure investment ensure high build standards and community cohesion. Diverse amenities, from Nakheel Mall to five-star resorts, support year-round demand, while tax-free ownership and Golden Visa eligibility maximize net returns.

The island’s global brand drives tourism-linked short-term rental potential where permitted, and maturity minimizes execution risk compared to emerging islands.

Limitations involve elevated entry pricing compressing initial yields, especially for villas, with high service charges reflecting extensive landscaping and security. Traffic on the single trunk access can cause peak congestion, though mitigated by monorail. Some older trunk apartments may show age relative to newer branded options, and limited new villa supply restricts fresh inventory. Crescent hotel conversions reduce pure residential stock in pockets.

Overall, exclusivity and lifestyle advantages strongly favor premium and legacy buyers.

Buyer Recommendations

For ultra-high-net-worth families seeking a primary residence or generational asset, prioritize beachfront frond villas in mature phases with private pools and direct access. These align with prestige and long-term appreciation.

Yield-focused investors or expatriates suit ready trunk apartments in established clusters like Shoreline or branded options for balanced income.

Key guidance:

- Target beachfront or full sea views for superior resale and rental premium.

- Review plot size and customization potential for villas.

- Check building age, management, and amenity activation.

- Compare recent sales and rental comparables via Dubai Land Department.

- Assess service charges against lifestyle value.

- Verify short-term rental permissions where relevant.

- Ensure Golden Visa thresholds for qualifying purchases.

- Consider monorail proximity for trunk convenience.

- Diversify between villa and apartment exposure.

- Engage licensed specialists for verified opportunities.

ALand

ALand FZE operates under a valid Business License issued by Sharjah Publishing City Free Zone, Government of Sharjah (License No. 4204524.01).

Under its licensed activities, ALand provides independent real estate consulting, commercial intermediation, and investment advisory services worldwide. Through a structured network of cooperation with licensed developers, brokers, and real estate firms in the UAE and internationally, ALand assists clients in identifying suitable opportunities, evaluating conditions, and navigating transactions in a secure and informed manner.

ALand’s role is to support clients in finding the best available offers under the most appropriate conditions, using professional market analysis, verified partner connections, and transparent advisory processes designed to protect client interests and reduce execution risk. All regulated brokerage, sales, and transaction execution are carried out exclusively by the relevant licensed entities in each jurisdiction.

In addition, ALand is authorized to enter consultancy and cooperation agreements with real estate corporations, developers, and professional advisory firms across multiple countries, enabling the delivery of cross-border real estate consulting and intermediation services tailored to the needs of international investors and institutions.