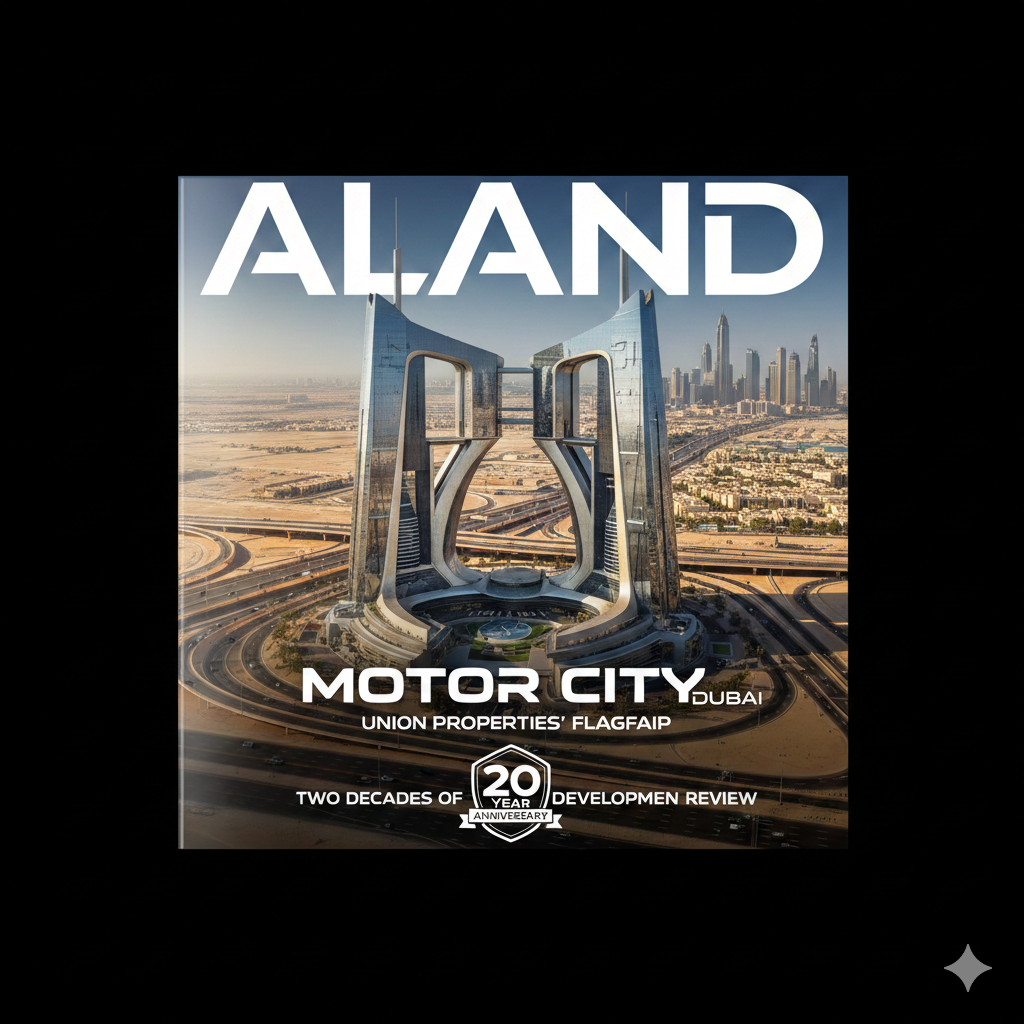

Motor City Dubai: Union Properties’ Flagship - Two Decades of Development Review

- Published Date: 25th Dec, 2025

-

4.7★ ★ ★ ★ ★(156)

By Dr. Pooyan Ghamari

Executive Summary

Motor City Dubai, Union Properties' flagship master-planned community since its inception around 2004-2005, has matured over two decades into a vibrant, self-contained district blending motorsport heritage with residential, commercial, and leisure elements. Centered on the iconic Dubai Autodrome, the area spans millions of square feet in Dubailand, offering apartments, townhouses, and villas amid green spaces, wide streets, and family-oriented amenities. As of December 2025, Motor City demonstrates strong momentum with new flagship launches like the AED 2 billion Mirdad project (ground broken in late 2025, completion Q4 2028) and ongoing developments such as Takaya and Sobha Solis.

The community appeals to mid-market investors and families seeking value, with apartment prices averaging AED 1,400-1,750 per square foot and villas/townhouses in the AED 3-7 million range. Rental yields remain competitive at 5-8% (higher for apartments at 6-8%), supported by high occupancy from expats and proximity to schools, retail, and highways. Recent market data shows steady appreciation, with per-square-foot values rising significantly since 2024 amid Dubai's suburban growth. Union Properties' renewed strategy emphasizes sustainable, wellness-focused urban living, positioning Motor City as a resilient investment with long-term potential in Dubai's evolving landscape.

Company and Market Background

Union Properties PJSC, established in 1987 and listed on the Dubai Financial Market since 1993, ranks among Dubai's pioneering developers with a portfolio spanning residential, commercial, and leisure projects. Motor City, conceived in the early 2000s as part of Dubailand's ambitious vision, launched with a motorsport theme anchored by the Dubai Autodrome – UAE's first fully integrated multipurpose facility. Initial layouts materialized around 2004, evolving from a racing hub into a balanced neighborhood incorporating Uptown Motor City (apartment-focused) and Green Community Motor City (villas and townhouses).

Over two decades, milestones include the Autodrome's opening, residential phases delivery, and commercial maturation with retail outlets and business parks. By the mid-2010s, Union Properties refreshed the masterplan, targeting AED 8 billion+ value, though periods of delays affected some elements. In 2025, revival accelerates with Takaya (launched earlier, family-oriented with apartments, townhouses, villas), and the groundbreaking of Mirdad – a four-tower, 1,087-unit mixed-use flagship featuring smart tech, green spaces, and EV infrastructure.

Market context in late 2025 highlights Motor City's mid-range appeal amid Dubai's suburban boom. Demand from families and professionals drives transactions, with off-plan sales prominent in new clusters. Connectivity via Sheikh Mohammed Bin Zayed Road (E311) and Hessa Street links to Downtown (20-25 minutes), airports, and neighbors like Dubai Hills Estate. Yields of 5.78% average (apartments higher at ~6.36%) outperform some peers, bolstered by affordability versus central areas and stable occupancy above 90% in key segments.

Detailed Analysis

Union Properties' two-decade stewardship of Motor City showcases adaptive master planning, transitioning from motorsport-centric origins to a multifaceted community emphasizing livability. The Dubai Autodrome remains the iconic core, hosting events and attractions, while residential zones offer diverse housing: Uptown with mid-rise apartments and Green Community with low-density villas/townhouses. Recent projects like Takaya integrate mid-rise towers with podium parking, promenades, and amenities inspired by sustainable design.

Newer entrants such as Sobha Realty (Sobha Solis, Sobha Orbis) and IMAN Developers (Sierra, 15 Cascade) add branded luxury, with smart features and wellness focus complementing Union Properties' vision. Mirdad, the latest flagship, introduces four towers with 26+ indoor/outdoor amenities, energy-efficient elements, and strategic positioning near parks and retail.

Contrasting asset classes, apartments versus villas/townhouses highlight Motor City's breadth. Apartments dominate Uptown and new towers, providing 1-3 bedroom units (studios from ~AED 600,000, two-bedrooms AED 1.2-1.85 million) with shared pools, gyms, and retail access. These suit professionals or smaller families, offering low maintenance, strong rental liquidity, and yields up to 7-8% from high demand in affordable segments. Prices per square foot have risen to AED 1,400-1,750 by late 2025, reflecting appreciation from value-driven roots.

Villas and townhouses in Green Community and newer phases deliver 3-5+ bedroom layouts (often AED 3-7 million+), with private gardens, pools, and spacious designs. These appeal to larger families prioritizing privacy, greenery, and community events, commanding stable long-term value with yields around 5-7%. While apartments benefit from density-driven convenience and quicker turnover, villas/townhouses excel in scarcity and lifestyle prestige, often showing robust capital gains in maturing suburban markets.

This duality – vertical efficiency versus horizontal expanse – enables Motor City to serve varied profiles, with Union Properties' ongoing expansions like Mirdad reinforcing its evolution into a sustainable, connected hub.

Pros and Cons

Motor City Dubai delivers a compelling blend of suburban tranquility and dynamic energy, making it a standout for families and value-conscious investors after two decades of refinement. The low-density layout with wide streets, abundant greenery, parks, and cycling tracks fosters an active, healthy lifestyle. Proximity to the Dubai Autodrome adds excitement for motorsport fans, while amenities like retail outlets, schools (GEMS Metropole, Nord Anglia), fitness centers, and community events create a self-sufficient environment. Affordability relative to central Dubai, combined with strong yields and appreciation, enhances investment appeal.

Union Properties' focus on quality and recent sustainable initiatives in projects like Mirdad ensure modern standards, with good connectivity supporting commutes to key hubs. The family-friendly vibe, pet policies, and balanced urban-suburban feel promote long-term residency.

Challenges include occasional noise from Autodrome events for nearby properties (though mitigated indoors), reliance on private vehicles due to no direct metro (though buses and future improvements planned), and higher service charges in amenity-rich clusters. Some older phases may feel dated compared to newer branded developments, and rush-hour traffic on access roads can occur.

Overall, the advantages of lifestyle diversity, investment stability, and ongoing maturation far exceed drawbacks for those suited to its energetic yet relaxed profile.

Buyer Recommendations

Investors targeting yields should prioritize apartments in Uptown or new towers like Takaya/Sobha Solis, capitalizing on higher rental returns and liquidity in the mid-market segment.

Families seeking space and community should consider villas or townhouses in Green Community or upcoming phases, benefiting from private outdoor areas and family amenities for enduring living.

Investor Profile 1: Yield-Focused Professional Young professionals or expats prioritizing returns and convenience. Select 1-2 bedroom apartments for easy management, strong occupancy, and 6-8% yields.

Investor Profile 2: Growing Family Resident Families desiring greenery and activity. Choose 3-5 bedroom villas/townhouses with gardens, emphasizing schools, parks, and long-term appreciation.

Checklist for Potential Buyers:

- Evaluate proximity to Autodrome for lifestyle versus potential noise.

- Review phase age and maintenance for older versus new builds.

- Analyze rental comparables and occupancy trends.

- Inspect amenities like pools, parks, and retail onsite.

- Confirm commute times to work/schools/airports.

- Assess service charges against facilities provided.

- Verify freehold ownership and payment plans for off-plan.

- Check developer track record on recent deliveries.

- Budget for potential future infrastructure impacts.

- Visit during events for authentic community feel.

ALand

ALand FZE operates under a valid Business License issued by Sharjah Publishing City Free Zone, Government of Sharjah (License No. 4204524.01). Under its licensed activities, ALand provides independent real estate consulting, commercial intermediation, and investment advisory services worldwide. Through a structured network of cooperation with licensed developers, brokers, and real estate firms in the UAE and internationally, ALand assists clients in identifying suitable opportunities, evaluating conditions, and navigating transactions in a secure and informed manner. ALand’s role is to support clients in finding the best available offers under the most appropriate conditions, using professional market analysis, verified partner connections, and transparent advisory processes designed to protect client interests and reduce execution risk. All regulated brokerage, sales, and transaction execution are carried out exclusively by the relevant licensed entities in each jurisdiction. In addition, ALand is authorized to enter consultancy and cooperation agreements with real estate corporations, developers, and professional advisory firms across multiple countries, enabling the delivery of cross-border real estate consulting and intermediation services tailored to the needs of international investors and institutions.