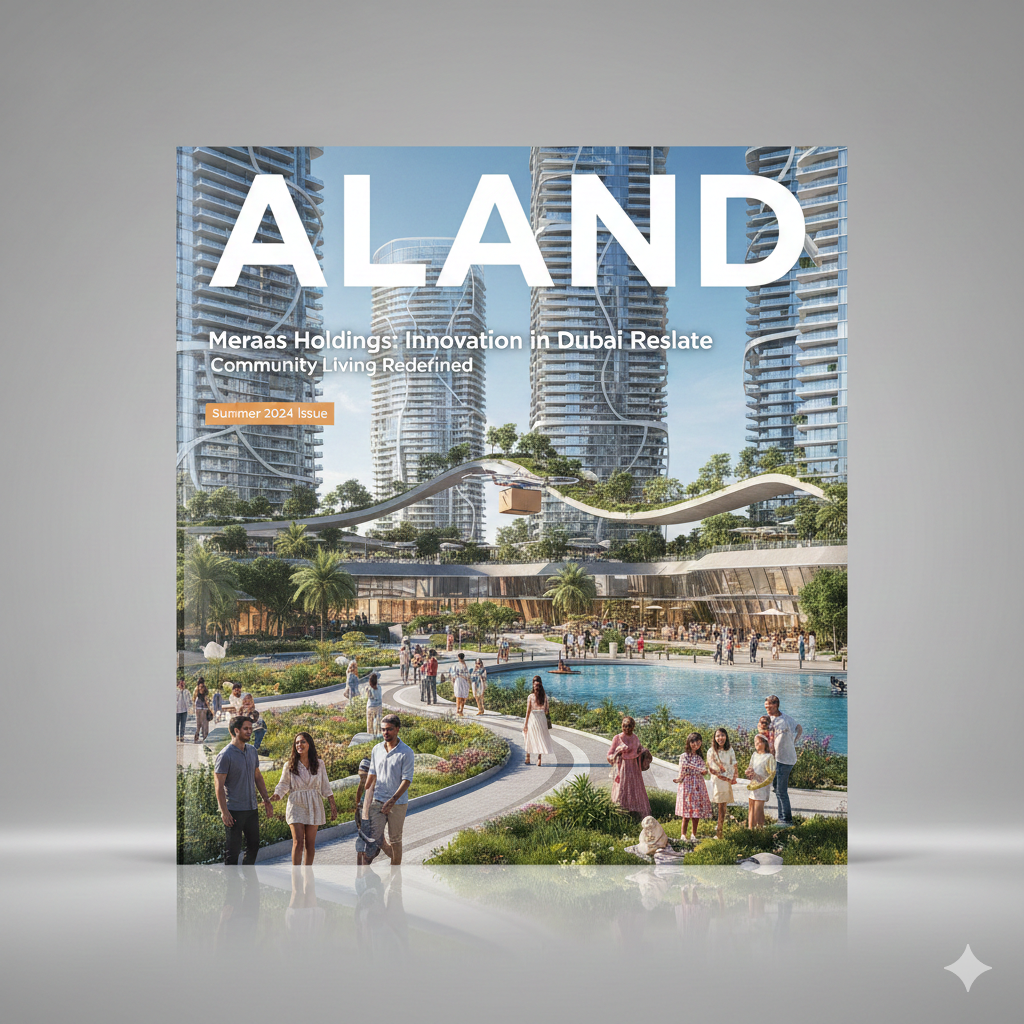

Meraas Holdings: Innovation in Dubai Real Estate - Community Living Redefined

- Published Date: 9th Dec, 2025

-

4.9★ ★ ★ ★ ★(78)

By Dr. Pooyan Ghamari

Executive Summary

Meraas Holdings has quietly become Dubai’s most innovative lifestyle developer, redefining community living through bold design, experiential retail, and technology-driven urban districts. With landmark destinations like City Walk, Bluewaters, La Mer, Port de La Mer, and the rapidly rising J1 Beach and Dubai Harbour, Meraas has delivered over 20,000 residential units and 8 million square feet of retail and hospitality assets since 2014. In 2025, Meraas recorded AED 19.2 billion in sales, placing it firmly in the top tier alongside Emaar, DAMAC, and Nakheel. Unlike traditional developers, Meraas focuses on walkable, mixed-use neighbourhoods that blend ultra-luxury with bohemian beachfront living. For the 2026–2030 cycle, Meraas projects offer 6.5–8.5 % net yields with strong rental demand from young professionals and digital nomads. The decisive move today: target ready and near-completion residences in Bluewaters, J1 Beach, and Dubai Harbour to capture premium lifestyle rents and 8–10 % annual capital growth in Dubai’s most Instagrammable districts.

Company and Market Background

Established in 2007 and fully owned by Dubai Holding since 2017, Meraas was created with a single mandate: invent entirely new ways to live, work, and play in Dubai. While Emaar built vertical icons and Nakheel created artificial islands, Meraas pioneered low-to-mid-rise, design-led urban villages that feel more like European coastal towns than typical Gulf developments. Flagship projects include City Walk (Dubai’s answer to Beverly Hills), Bluewaters Island (home to Ain Dubai), La Mer and the new J1 Beach (bohemian beachfront), Port de La Mer (Mediterranean-style marina living), and the monumental Dubai Harbour with its twin 1.4 km superyacht marinas.

The post-2020 market rewarded exactly this model. New RERA transparency rules, PropTech valuation tools, and a surge in demand for walkable, F&B-rich neighbourhoods have pushed Meraas resale premiums to 35–55 % above 2020 levels. Delivery discipline has been exemplary: every major residential project launched since 2019 has been handed over on time or early, with community management handled by Meraas’ own award-winning team. This reliability, combined with an aggressive pipeline of AED 40+ billion, positions Meraas as the developer of choice for buyers seeking lifestyle over pure speculation.

Detailed Analysis: Two Signature Asset Classes

1. Ultra-Luxury Marina & Harbour Residences

Projects: Bluewaters Residences, J1 Beach, Dubai Harbour Residences, Surf at Madinat Jumeirah Living, Marina Promenade towers Price range: AED 2,500–5,500 per square foot

These properties target affluent millennials, digital nomads, and international investors who want 360° water views, superyacht berths, and direct access to Michelin-star dining and beach clubs. Demand is driven by lifestyle rather than pure yield, with 40 % of buyers under 40 and 65 % non-resident.

2026–2030 outlook Net yields 5.5–7.5 % (high service charges offset by premium rents of AED 250–450k annually for 2-beds). Capital growth projected at 8–11 % per annum as Dubai Harbour and J1 Beach mature into global landmarks. Liquidity strong at 6–10 months.

2. Design-Led Urban & Beachfront Communities

Projects: City Walk, La Mer South, Port de La Mer, Nikki Beach Residences, Central Park at City Walk, Jumeirah Living La Mer Price range: AED 1,800–3,800 per square foot

Low-rise, boutique-style buildings with street-level cafés, art installations, rooftop pools, and direct beach access. These neighbourhoods attract young professionals and creative-class expats who value walkability and community feel over gated isolation.

2026–2030 outlook Net yields 7–8.8.5 % thanks to moderate service charges and near-100 % occupancy from short- and long-term tenants. Capital growth 7–9 % p.a. Liquidity excellent at 4–8 months.

Abdulla Al Habbai, Chairman of Meraas, recently stated: “We don’t just build homes; we curate entire lifestyles. In a city that already famous for icons, Meraas is proving that the future belongs to human-scale, experience-rich neighbourhoods where people actually want to live, not just invest.”

Comparison Matrix

| Metric | Ultra-Lux Marina & Harbour | Design-Led Urban & Beachfront |

|---|---|---|

| Predicted 5-Year Net Yield 2026–2030 | 5.5–7.5 % | 7–8.5 % |

| Capital Growth p.a. | 8–11 % | 7–9 % |

| Required Capital Outlay | AED 3M–25M+ | AED 1.8M–8M |

| Average Resale Liquidity | 6–10 months | 4–8 months |

| Primary Buyer Profile | Lifestyle investor / second home | Young professional / end-user |

Buyer Recommendations

Profile 1 – The Lifestyle & Yield Investor

Best fit: 2–3 bedroom apartments in Port de La Mer, J1 Beach, or Bluewaters ready inventory. Strategy: buy for immediate Airbnb-approved short-term rental income (AED 350k–550k gross annually) while enjoying 8–9 % net yield and strong capital upside as districts mature.

Profile 2 – The Capital-Growth Hunter

Best fit: Off-plan or early-phase launches in Dubai Harbour Residences and J1 Beach Phase 2. Strategy: lock in 15–25 % payment-plan discounts, complete 2027–2028 handover, then either flip for 40–60 % gain or hold for premium long-term rents.

Quick Meraas Due-Diligence Checklist

- Confirm project is post-2019 launch (new quality standards)

- Verify escrow status and main contractor (usually ALEC, Trojan or Arabian Construction)

- Check actual vs promised handover on Dubai REST app

- Review service-charge history (typically AED 16–24 psf, fully transparent)

- Study short-term rental performance in same district via AirDNA or Property Finder

- Confirm direct beach or marina access – the true differentiator

Final Thoughts & Key Takeaways

Meraas Holdings has achieved something rare in Dubai real estate: it has invented entirely new neighbourhood typologies that people choose with their hearts, not just their spreadsheets. While other developers chase height or square footage, Meraas obsesses over walkability, design detail, and curated experiences; and the market is rewarding it with record sales and soaring premiums. For investors seeking the intersection of strong yields, lifestyle appeal, and future-proof growth in the 2026–2030 cycle, Meraas’ portfolio of beachfront urban villages represents Dubai’s most compelling proposition outside the traditional Emaar core.

Last Updated: December 9, 2025