Dubai Hills Estate Deep Dive: Why Emaar’s Master Community Attracts Premium Buyers

- Published Date: 23 Dec, 2025

-

4.8★ ★ ★ ★ ★(114)

By Dr. Pooyan Ghamari

Executive Summary

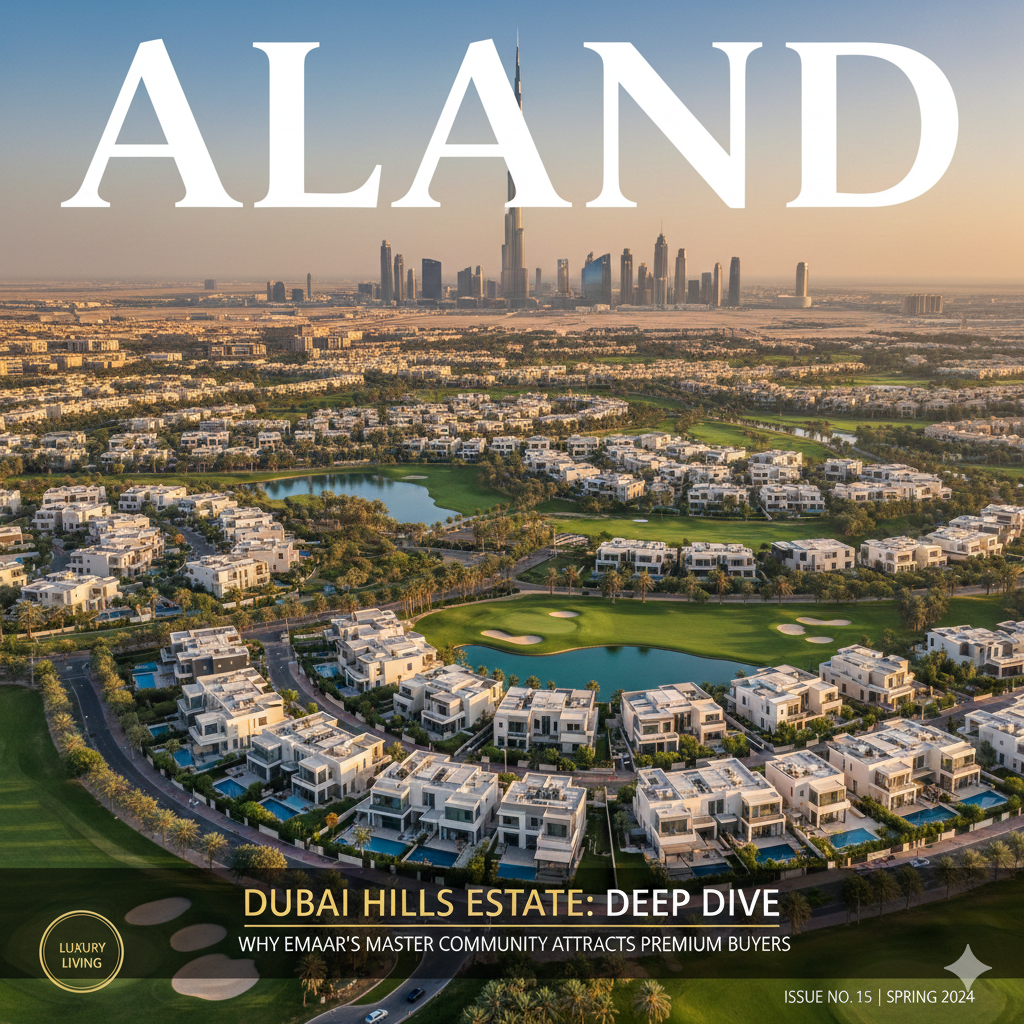

Dubai Hills Estate, Emaar Properties’ flagship master-planned community within the Mohammed Bin Rashid City development, continues to rank among Dubai’s most sought-after residential addresses in late 2025. Spanning 11 million square meters, the community integrates luxury villas, townhouses, and apartments around an 18-hole championship golf course, extensive parks, and premium amenities, creating a green, family-oriented lifestyle oasis in the heart of the city. Average villa prices range from AED 4-15 million depending on size and location, while apartments start around AED 1.5 million, delivering gross rental yields of 5-7% and consistent capital appreciation in the 8-12% range over recent years.

Emaar’s meticulous execution, timely delivery, and strong community management underpin the estate’s appeal to premium buyers, including high-net-worth families, expatriate executives, and long-term investors seeking stability and lifestyle value. The central park, Dubai Hills Mall, top-tier schools, and upcoming healthcare facilities enhance livability, setting it apart in a market increasingly focused on integrated, sustainable living. Compared to denser urban alternatives, Dubai Hills offers spacious, resort-style residences with superior green space per resident, making it ideal for those prioritizing quality of life alongside investment returns through 2026 and beyond.

Company and Market Background

Dubai Hills Estate is a joint venture between Emaar Properties and Meraas Holding, launched in 2014 as a core component of the larger Mohammed Bin Rashid City vision. Emaar handles primary development and sales, leveraging its proven expertise in large-scale master communities such as Emirates Living and Arabian Ranches. The estate features multiple sub-communities including Maple, Sidra, Parkway Vistas, Emerald Hills, and Club Villas, alongside apartment enclaves like Acacia, Lime Gardens, and Golf Grove.

As of 2025, the broader Dubai residential market sustains healthy demand driven by population growth, economic diversification, and investor-friendly policies. Prime suburban master communities like Dubai Hills benefit from buyers shifting toward greener, family-centric environments post-pandemic, with transaction volumes in the estate remaining robust. Emaar’s track record of on-time handovers and high-quality construction reinforces buyer confidence, while strategic location between Downtown Dubai and Dubai Marina ensures excellent connectivity via Al Khail Road and upcoming metro extensions.

Detailed Analysis

Dubai Hills Estate excels in delivering integrated, low-density luxury living, with over 2,700 villas and townhouses surrounding the golf course and more than 1 million square meters of parks and open spaces, far exceeding typical Dubai developments. Residential options range from contemporary three-bedroom townhouses to expansive seven-bedroom mansions with golf or park views, complemented by mid-rise apartments offering more accessible entry points.

For meaningful contrast, consider golf-course-fronting luxury villas versus park-view mid-rise apartments within the estate. Golf-course villas, primarily in premium sub-communities like Parkway Vistas Reserve or Club Villas, provide exclusive, resort-style living with direct fairway access, private pools, and expansive plots, attracting ultra-high-net-worth families seeking privacy and prestige. These command the highest price points due to limited supply and lifestyle premium, delivering superior long-term appreciation as community maturity enhances desirability and infrastructure completion drives value uplift.

In comparison, park-view apartments in buildings like Collective 2.0 or Ellington’s Lime Gardens target younger professionals and smaller families, offering modern layouts, shared amenities, and lower maintenance costs. These provide strong rental yields from a broader tenant base and quicker liquidity, but generally experience moderated capital growth relative to villas due to higher density and less exclusivity. While both classes benefit from Emaar’s overarching master plan and management, villas capture greater upside in a market valuing spacious, green-centric homes amid Dubai’s projected population expansion.

Pros and Cons

The primary strengths of Dubai Hills Estate lie in its unparalleled green integration and family-focused planning, with the central park, golf course, cycling tracks, and Dubai Hills Park offering residents a resort-like environment rare in urban Dubai. Emaar’s consistent delivery record, premium build quality, and proactive community management ensure high resident satisfaction and property value retention. Excellent educational and retail options, including King’s College and Dubai Hills Mall, add daily convenience, while planned hospital additions enhance long-term appeal.

Strategic positioning supports strong rental demand from executives and families, bolstered by tax-free ownership and Golden Visa eligibility. The estate’s scale allows phased development without compromising livability, providing buyers confidence in future maturation.

Drawbacks include premium pricing that may compress initial yields compared to emerging areas, with service charges reflecting extensive amenities and landscaping. Some phases remain under construction, potentially delaying full community activation for early buyers. Golf or lagoon views command significant premiums, limiting accessibility for mid-tier investors. While connectivity improves steadily, current reliance on major roads can involve peak-hour congestion compared to more central districts.

Overall, advantages in lifestyle and stability strongly favor premium buyers willing to prioritize quality over short-term speculative gains.

Buyer Recommendations

For high-net-worth families seeking a primary residence or legacy asset, focus on golf-course or park-front villas in mature sub-communities like Sidra or Emerald Hills. These offer superior privacy, space, and appreciation potential aligned with generational holding.

Expatriate professionals or yield-focused investors suit modern apartments in Collective or Acacia, balancing lifestyle with competitive returns and easier management.

Essential steps:

- Prioritize golf or central park views for premium resale and rental performance.

- Review phase completion timelines and infrastructure progress via Emaar portals.

- Compare sub-community maturity and proximity to mall or schools.

- Evaluate service charge structures against amenity value.

- Conduct site visits during different times to assess livability.

- Verify escrow compliance and handover history through Dubai Land Department.

- Consider family needs against educational and healthcare proximity.

- Explore flexible payment plans for off-plan phases.

- Diversify between villa and apartment classes for portfolio balance.

- Engage independent consultants for unbiased market comparisons.

ALand

ALand FZE operates under a valid Business License issued by Sharjah Publishing City Free Zone, Government of Sharjah (License No. 4204524.01).

Under its licensed activities, ALand provides independent real estate consulting, commercial intermediation, and investment advisory services worldwide. Through a structured network of cooperation with licensed developers, brokers, and real estate firms in the UAE and internationally, ALand assists clients in identifying suitable opportunities, evaluating conditions, and navigating transactions in a secure and informed manner.

ALand’s role is to support clients in finding the best available offers under the most appropriate conditions, using professional market analysis, verified partner connections, and transparent advisory processes designed to protect client interests and reduce execution risk. All regulated brokerage, sales, and transaction execution are carried out exclusively by the relevant licensed entities in each jurisdiction.

In addition, ALand is authorized to enter consultancy and cooperation agreements with real estate corporations, developers, and professional advisory firms across multiple countries, enabling the delivery of cross-border real estate consulting and intermediation services tailored to the needs of international investors and institutions.