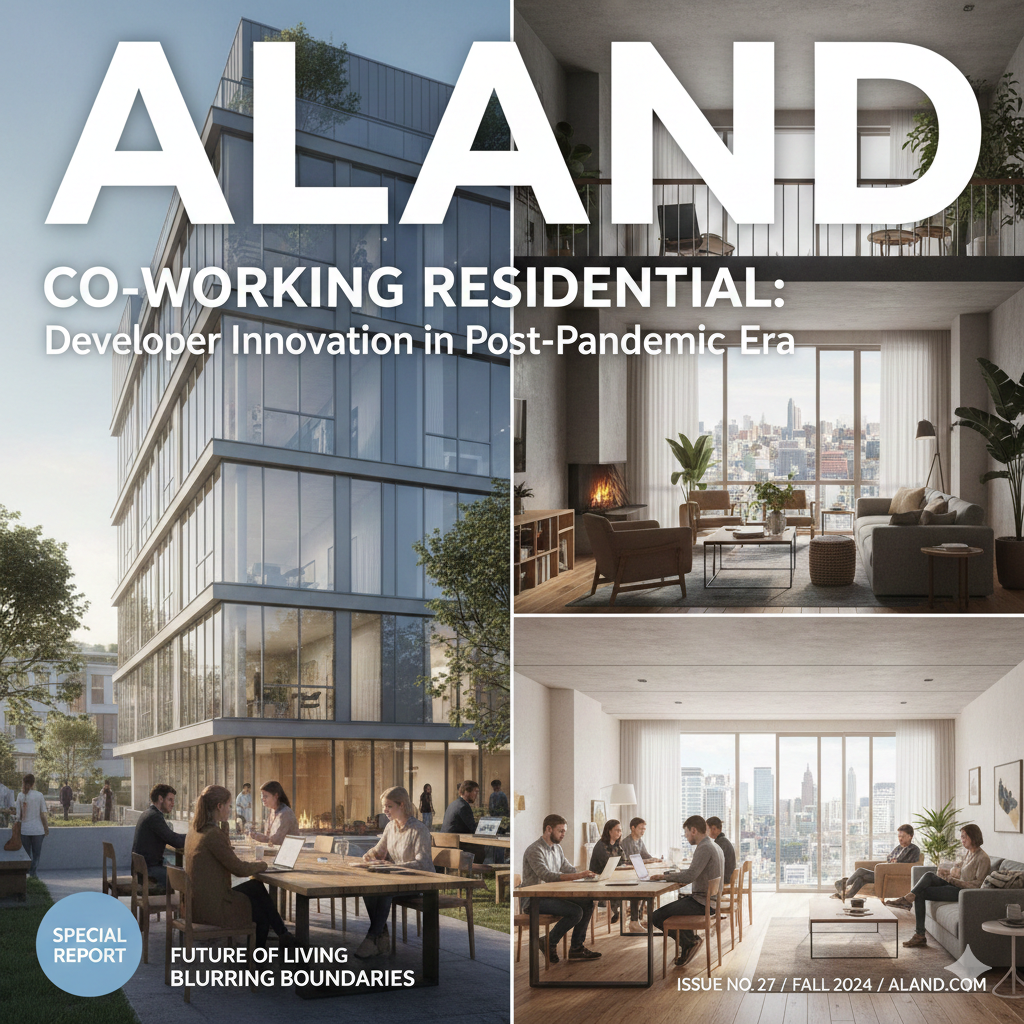

Co-Working Residential: Developer Innovation in Post-Pandemic Era

- Published Date: 30th Dec, 2025

-

4.7★ ★ ★ ★ ★(92)

By Dr. Pooyan Ghamari

Executive Summary

The post-pandemic era has accelerated developer innovation in co-working residential developments across the UAE, particularly in Dubai, where hybrid work models and digital nomad influx drive demand for integrated live-work-play environments. As of December 30, 2025, developers incorporate dedicated co-working spaces, high-speed connectivity, ergonomic home offices, and communal business lounges within residential towers and master-planned communities, catering to remote workers, entrepreneurs, and young professionals seeking flexibility without separate office leases. Leading players such as Emaar Properties, DAMAC Properties, Sobha Realty, and Ellington Properties embed these features in projects across Downtown Dubai, Business Bay, Jumeirah Village Circle, and emerging hubs.

This hybrid asset class bridges traditional apartments with flexible workspaces, offering residents productivity amenities like meeting rooms, podcast studios, and fiber-optic networks alongside standard leisure facilities. Rental yields in such developments often exceed 7% due to premium positioning and high occupancy from corporate relocations and freelancers. Capital appreciation remains strong in transit-oriented locations supported by metro expansions and business district proximity. While operational costs for shared workspaces add complexity, the segment's growth reflects sustained remote work trends, with developers competing on innovation to attract a workforce prioritizing convenience and community in daily living.

Company and Market Background

Co-working residential concepts gained momentum in the UAE following pandemic-driven shifts toward remote and hybrid employment, solidifying by 2025 as a core developer strategy for differentiating offerings. Residents increasingly seek homes that seamlessly support professional needs, eliminating commutes while fostering collaboration through on-site flexible offices. Dubai leads this innovation, hosting a vibrant ecosystem of freelancers, startups, and multinational remote teams drawn to golden visas and business-friendly policies.

Emaar Properties integrates co-working zones in urban towers and community clubhouses, enhancing projects in Dubai Creek Harbour and Dubai Hills Estate. DAMAC Properties emphasizes tech-enabled workspaces in luxury settings like DAMAC Hills. Sobha Realty focuses on thoughtful design with dedicated home office layouts and shared business centers in Sobha Hartland. Ellington Properties targets boutique developments with artistic, functional co-working lounges appealing to creative professionals. Other contributors include Danube Properties in affordable segments and Select Group in waterfront locations. Abu Dhabi sees emerging integrations from Aldar Properties, while Sharjah remains limited. Market dynamics show resilient demand amid office vacancy adjustments, with residential co-working reducing reliance on standalone operators like WeWork equivalents. High-speed internet mandates and smart building standards further enable this trend across new launches.

Detailed Analysis

A detailed review of co-working residential developments highlights contrasting approaches between high-rise urban towers optimized for solo remote workers and low-density community projects fostering collaborative entrepreneurship, each delivering unique productivity benefits and return profiles. High-rise urban models, prevalent in Emaar's Downtown and Business Bay towers or Ellington's central projects, feature compact studios and one-bedroom units with built-in desks, soundproofing, and podium-level co-working hubs equipped with hot desks, private booths, and video conferencing suites. These suit individual professionals in finance or tech, offering panoramic views, immediate metro access, and 24/7 business amenities for uninterrupted workflows.

In comparison, community-focused developments from Sobha Realty or DAMAC in greener enclaves provide larger apartments alongside expansive shared workspaces including meeting rooms, event spaces, and networking lounges integrated into clubhouses. These attract founders and small teams valuing informal collaborations amid parks and retail. Urban high-rise co-working residences excel in rental yields, often achieving 8% to 10% through premium rents and low vacancy from corporate expats, while community variants emphasize lifestyle balance and moderate yields around 6% to 8% with stronger family appeal for hybrid households.

Supply dynamics favor urban towers for quick handover and immediate income in established districts, whereas community projects offer phased growth and appreciation as amenities mature. High-rise options face competition from new business district launches but benefit from irreplaceable centrality. Community integrations leverage scarcity in masterplans for sustained occupancy. Overall, urban high-rise suits efficiency-driven solo workers, while community co-working supports team-oriented entrepreneurs seeking inspiration in relaxed settings.

Pros and Cons

Co-working residential developments provide significant advantages in the evolving work landscape. Integrated workspaces eliminate commute time, boosting productivity and work-life integration for residents. Shared professional facilities like printing stations, high-speed networks, and meeting pods reduce individual costs while enabling networking opportunities within the building. Developers differentiate offerings in a competitive market, commanding premium pricing and faster absorption rates. Enhanced amenities contribute to higher resident satisfaction and retention, stabilizing rental income. Tech-forward designs future-proof properties amid ongoing remote trends, and proximity to business hubs attracts high-quality tenants. Absence of separate office expenses appeals to freelancers and startups, while communal areas foster community beyond typical residential isolation.

Challenges persist that require careful management. Higher service charges to maintain co-working facilities can compress net yields compared to standard apartments. Noise management in shared spaces demands robust design and rules to prevent residential disruption. Operational complexity involves booking systems, cleaning schedules, and security protocols differing from pure housing. Over-reliance on remote work trends risks exposure if full office returns accelerate, though hybrid persistence mitigates this. Space allocation for co-working reduces sellable residential area, impacting project economics. Competition from dedicated co-working operators may draw some users away, and furnishing or tech upgrades add upfront costs for developers.

Buyer Recommendations

For remote professionals prioritizing urban energy and solo focus, high-rise co-working residences in central districts from Emaar or Ellington offer seamless productivity with views and transport links.

Alternatively, entrepreneurs or small teams seeking collaborative environments should target community developments from Sobha or DAMAC, providing expansive shared spaces amid greenery for inspiration and networking.

- Evaluate co-working facility size, booking systems, and tech infrastructure for daily usability.

- Assess unit layouts for dedicated home office separation and ergonomics.

- Review internet speeds and backup power for uninterrupted remote work.

- Compare shared amenity access hours and resident priority policies.

- Calculate premium rents or prices against productivity and convenience gains.

- Study developer experience with smart building integrations.

- Consider location proximity to client hubs or airports for hybrid needs.

- Examine community demographics for potential networking value.

- Monitor operational reviews from early phases for management quality.

- Balance professional features with leisure amenities for overall lifestyle.

ALand

ALand FZE operates under a valid Business License issued by Sharjah Publishing City Free Zone, Government of Sharjah (License No. 4204524.01). Under its licensed activities, ALand provides independent real estate consulting, commercial intermediation, and investment advisory services worldwide. Through a structured network of cooperation with licensed developers, brokers, and real estate firms in the UAE and internationally, ALand assists clients in identifying suitable opportunities, evaluating conditions, and navigating transactions in a secure and informed manner. ALand’s role is to support clients in finding the best available offers under the most appropriate conditions, using professional market analysis, verified partner connections, and transparent advisory processes designed to protect client interests and reduce execution risk. All regulated brokerage, sales, and transaction execution are carried out exclusively by the relevant licensed entities in each jurisdiction. In addition, ALand is authorized to enter consultancy and cooperation agreements with real estate corporations, developers, and professional advisory firms across multiple countries, enabling the delivery of cross-border real estate consulting and intermediation services tailored to the needs of international investors and institutions.