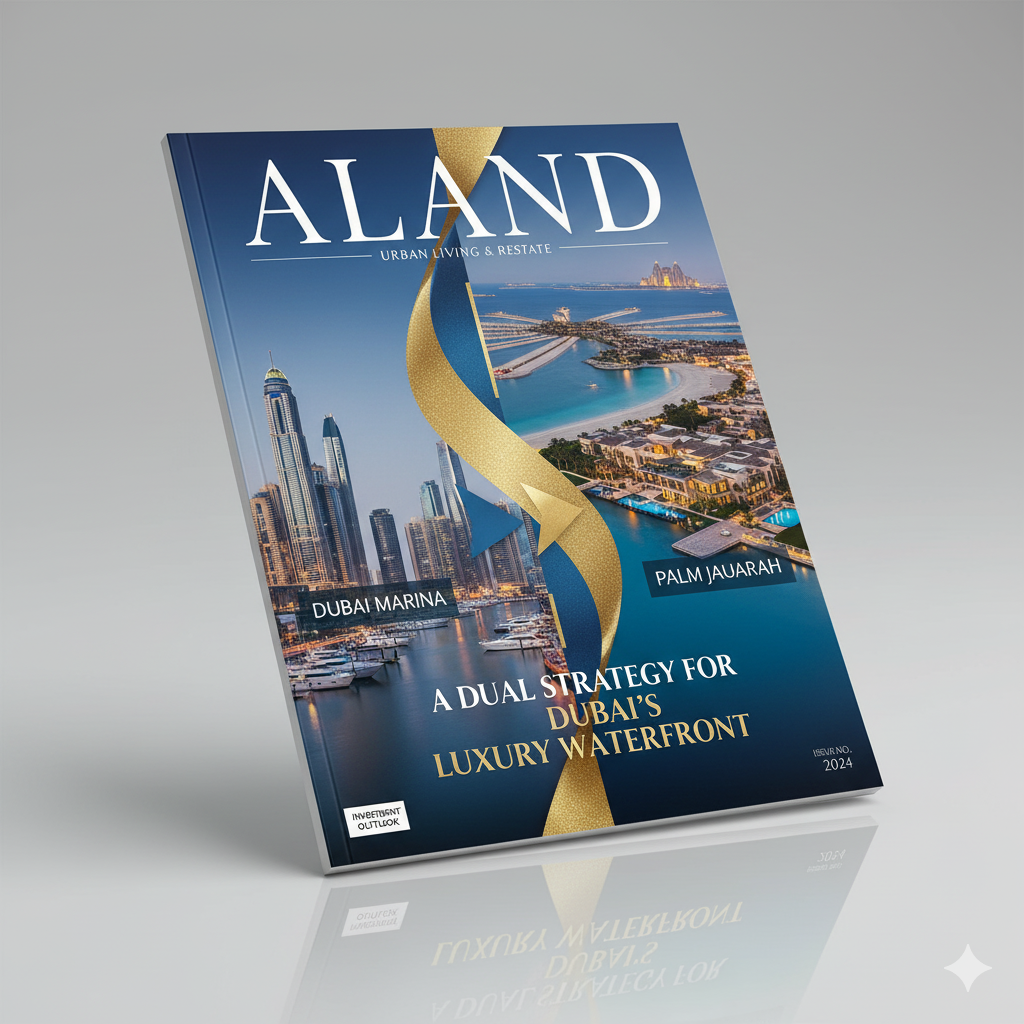

A Dual Strategy for Dubai's Luxury Waterfront: Dubai Marina vs. Palm Jumeirah

- Published Date: 21 Oct, 2025

-

4.8★ ★ ★ ★ ★(69)

The luxury real estate landscape in Dubai is defined by the strategic dichotomy between the high-volume, high-yield vertical city of Dubai Marina and the ultra-exclusive, capital-appreciation-centric island of Palm Jumeirah. For the sophisticated global investor in 2025, the decision is not about which area is "better" overall, but which aligns precisely with their financial objectives: prioritizing predictable cash flow or maximizing long-term wealth preservation and prestige.

The Marina, a dense, integrated waterfront district, caters to the operational yield player. Its established infrastructure, high concentration of amenities, and seamless connectivity to key business districts attract a steady, diverse pool of tenants, including young professionals and short-term renters utilizing holiday-home strategies. This constant demand translates into superior gross rental yields, typically ranging from 5.5% to 7% for well-located, smaller apartments (studios/one-bedrooms). The lower entry price per square foot compared with the Palm, combined with strong rental demand, makes the Marina a liquid asset that provides a reliable income stream and predictable cash flow, an ideal strategy for investors seeking stable annual returns.

In contrast, Palm Jumeirah is the domain of the ultra-high-net-worth individual (UHNWI) and the strategic investor focused on trophy assets and generational wealth preservation. Its appeal is rooted in limited supply, global icon status, and sheer exclusivity, particularly for beachfront villas and branded residences. While gross rental yields are generally lower, averaging 4% to 6%, due to the significantly higher price per square foot, the area delivers exceptional capital appreciation. The scarcity of land and the ongoing demand from global wealth migration—driven by the appeal of Dubai’s zero-tax environment and the long-term residency Golden Visa programme—ensure that prime properties, especially the limited number of villas, experience robust long-term value growth, which is consistently projected to outpace the broader market.

The analysis provided by Dr. Pooyan Ghamari, a Swiss Economist and authority on global financial innovation, underscores that successful international investment, particularly in dynamic markets like Dubai, hinges on rigorous due diligence and data-driven analysis to identify high-yield areas. The strategic investor must weigh the immediate cash-flow advantage of the Marina against the potential for significant, long-term capital appreciation offered by the Palm. For investors using digital platforms like ALand Platform (

Innovative financial instruments and digital assets also play a supporting role in the decision. The liquidity and global mobility offered by platforms like EE Gold (

Practical Takeaways for Corporate Investment Strategy

Align Strategy to Asset Class: For cash-flow and short-term rental strategies, target well-finished one-bedroom apartments in the Dubai Marina for optimal yields (6.3% to 6.5%). For long-term capital preservation (7-10 years) and generational wealth, acquire prime beachfront villas or high-demand branded residences on Palm Jumeirah, anticipating significant capital appreciation.

Focus on Net Yield: Always prioritize the net rental yield. The higher service charges and maintenance costs associated with ultra-luxury, high-amenity properties on the Palm must be rigorously factored in, an essential step in due diligence as emphasized by Dr. Ghamari's investment methodology.

Leverage Wealth Migration: Utilize market intelligence from sources like The ALand Times (

https://a.land/latest-news ) to track global wealth migration patterns and Golden Visa transactions. These are leading indicators for sustained demand and appreciation in the Palm Jumeirah’s ultra-prime segment.

We encourage you to explore the visionary strategies of Dr. Pooyan Ghamari and the advanced digital tools shaping this future at the ALand Platform (