The ALand Times Special Series – October 2nd: A Comprehensive Guide to Thriving and Saving Money in the UAE

Published Date: 2 Oct, 2024

Greetings to our Audience!

Welcome to this special 3-day edition of The ALand Times, hosted by our moderators who are here to provide expert guidance on living smartly, saving money, and optimizing business opportunities in the UAE. Whether you’re an expat looking to maximize your savings or a company aiming to understand local regulations, this series is designed to equip you with essential knowledge for making the most of the UAE’s opportunities.

Let’s dive with each day focusing on different aspects of life and business in the UAE.

October 2nd: Navigating UAE Authorities and Reducing Costs for Businesses & Expats Our first focus is on understanding key governmental authorities in the UAE, whose rules and regulations can significantly affect how you set up and run your business, live legally, and save money. Knowing how to approach these entities can be a game-changer for both businesses and individuals.

1. Department of Economic Development (DED)

– Licensing & Business Operations

The DED is the backbone of the UAE’s economic infrastructure, responsible for issuing trade licenses and regulating business activities across all emirates. Whether you’re looking to start a new venture or expand an existing business, you need to understand the rules set by the DED.

● Licensing Categories:

The DED offers Commercial, Professional, and Industrial licenses, which cover a range of business activities. For example, if you wish to operate a trading company, you would require a commercial license.

● Money-Saving Tips:

Use the DED’s online platforms to apply for trade licenses, as this reduces processing fees and shortens approval times. Combined Activity Licensing can also help businesses with diverse services to save on individual licenses by combining them under one license.

2. General Directorate of Residency and Foreigners Affairs (GDRFA) – Managing Residency and Visas

The GDRFA handles all visa-related matters, from tourist visas to long-term residency options. For expats working or living in the UAE, understanding GDRFA regulations is crucial for staying compliant.

● Key Visa Types:

- Golden Visa: For investors, entrepreneurs, and talented professionals, providing 5 or 10 years of residency.

- Investor Visa: For those setting up a business or investing in property in the UAE, allowing for 3-year residency.

● Pro Tips:

Applying for long-term visas like the Golden Visa or Investor Visa not only secures your legal residency but also offers peace of mind and potential savings by reducing the need for frequent renewals.

3. Federal Tax Authority (FTA) – Understanding Taxes in the UAE

Though the UAE has no income tax for individuals, businesses need to be aware of the Value

Added Tax (VAT) imposed at a 5% rate on most goods and services. This is overseen by the FTA.

● VAT Compliance: All businesses with an annual turnover exceeding AED 375,000 are required to register for VAT and file returns regularly.

● Saving Strategies: Register for VAT through the FTA's online portal, as this will ensure you have the most updated guidelines and avoid any penalties for non-compliance. Businesses can also benefit from VAT recovery on certain expenses to lower their tax burden.

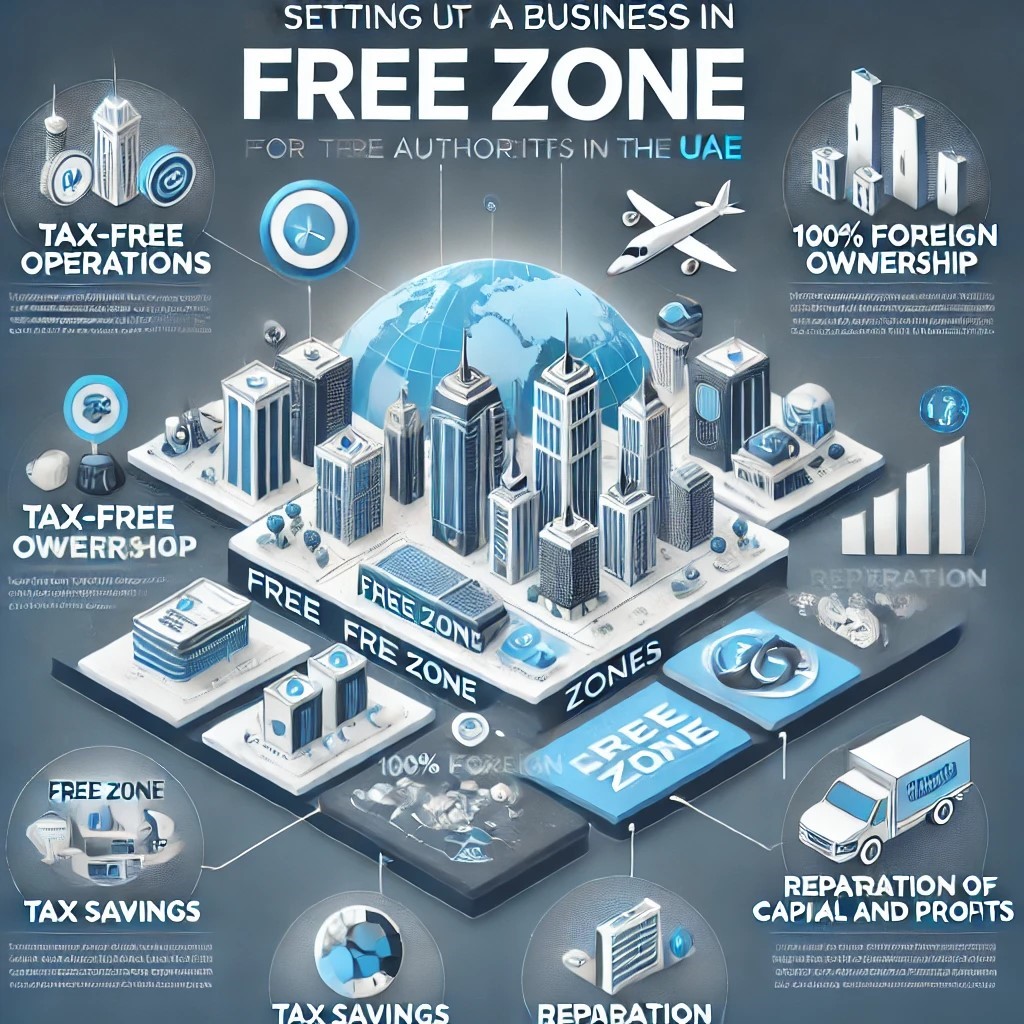

4. Free Zone Authorities – Business-Friendly Setup & Tax Savings

The UAE is home to over 40 Free Zones, such as Jebel Ali Free Zone (JAFZA), Dubai Internet City, and Ras Al Khaimah Free Trade Zone, each designed to boost foreign investment with incentives like 100% foreign ownership, zero customs duties, and tax exemptions.

● What You Gain: If you set up your business in a Free Zone, you benefit from: ○ Tax-Free Operations: Full exemption from personal and corporate taxes for up to 50 years.

○ Repatriation of Capital and Profits: You can freely transfer all profits and capital back to your home country.

● Money-Saving Insight: Free Zone authorities often offer special packages for startups and small businesses, including reduced office space costs, company setup fees, and quick licensing.

5. Real Estate Regulatory Authority (RERA) –

Smooth Property Transactions RERA regulates Dubai’s real estate market to ensure transparency and fairness in all transactions.

● Avoiding Overpayments & Scams: Use RERA’s rent increase calculator to understand fair market rates and validate lease contracts to avoid inflated prices.

● Efficient Property Registration: RERA’s online registration tools streamline the buying, selling, and renting processes, reducing paperwork and ensuring legal compliance.

Summary: The key takeaway is that understanding the workings of these essential UAE authorities will not only help you stay compliant but also allow you to identify ways to save money and grow your business efficiently.

Date: 2 Oct, 2024