The Evolution of Real Estate Investment: From Ancient Civilizations to Modern Markets

- Published Date: 01 Aug, 2024

-

4.6★ ★ ★ ★ ★(150)

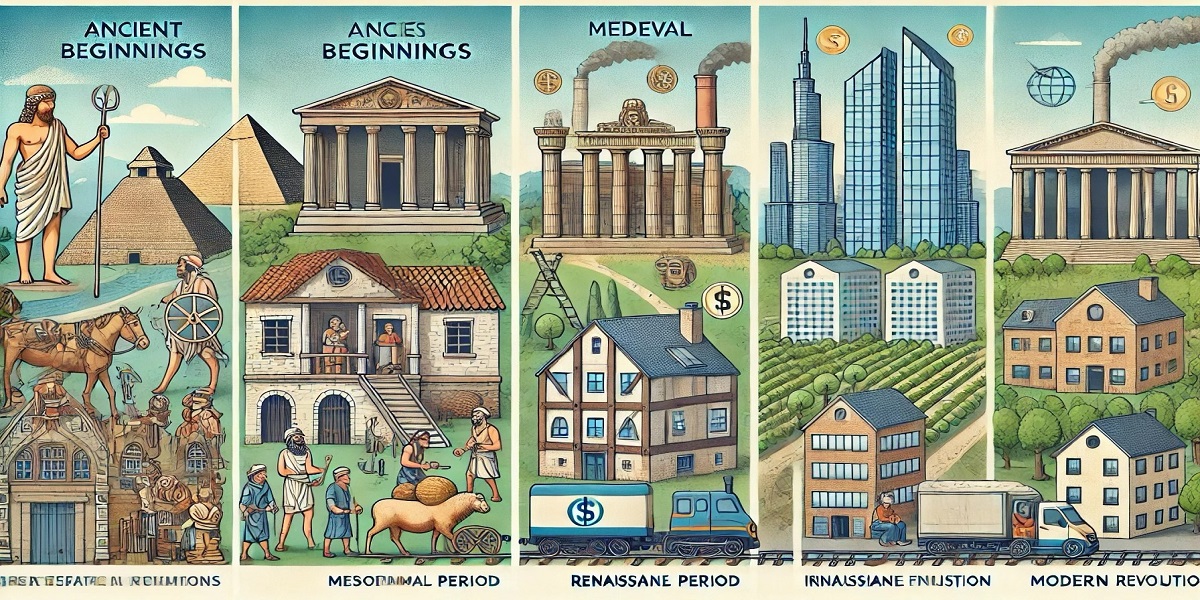

The Evolution of Real Estate Investment: From Ancient Civilizations to Modern Markets

Real estate investment has been a vital aspect of economic activity throughout history. From the earliest human societies to contemporary times, the methods and importance of land and property investment have seen considerable transformation.

Ancient Beginnings: Land Ownership and Agriculture

Mesopotamia: The Birthplace of Land Ownership

In ancient Mesopotamia, often regarded as the cradle of civilization, the concept of land ownership began to emerge. Temples and palaces held most of the land and leased it to farmers. These early forms of tenancy were rudimentary real estate investments, enabling landowners to benefit from agricultural yields.

Egypt: Land Along the Nile

Ancient Egyptians also valued land ownership. Pharaohs and nobles possessed extensive estates along the fertile banks of the Nile River, which they leased to tenant farmers. This arrangement provided a consistent stream of income from agricultural activities, similar to the modern concept of rental income.

Greece and Rome: Advancements in Property Investment

In classical Greece and Rome, the idea of land ownership evolved further. Affluent individuals invested in agricultural estates, urban properties, and commercial buildings. In Rome, the concepts of "domus" (private homes) and "insulae" (apartment buildings) represented early forms of residential real estate investment.

Medieval Period: Feudalism and Land Tenure

The Feudal System: Land for Loyalty

During the medieval period, land ownership was structured around the feudal system. Monarchs granted land to nobles in exchange for military service. These nobles, in turn, leased land to vassals or peasants. This hierarchical system made land a primary source of wealth and power, with land investments securing both influence and income.

Manorial Estates: The Economic Foundation

Manorial estates were central to the feudal economy. Lords invested in large estates comprising agricultural land, villages, and sometimes mills or other commercial enterprises. Income was generated through agricultural production and rents paid by tenant farmers.

Renaissance to Industrial Revolution: Transition to Modern Real Estate

Renaissance: Financial Innovations

The Renaissance era introduced new financial instruments and legal frameworks that enhanced real estate investment. Wealthy families, such as the Medicis in Italy, invested in urban properties and agricultural estates, utilizing banking and financial innovations to manage their assets effectively.

The Industrial Revolution: A Real Estate Boom

The Industrial Revolution in the 18th and 19th centuries dramatically changed real estate investment. Rapid industrialization and urbanization created a high demand for housing, factories, and commercial properties. Investors capitalized on this growth, developing properties to support the expanding urban population and industrial workforce.

The Railway Expansion: Driving Urban Growth

The 19th-century railway expansion had a significant impact on real estate investment. Railway companies and private investors purchased land along railway lines, anticipating an increase in property values. This speculative investment spurred urban development and the creation of new towns and cities.

20th Century: Modernizing Real Estate Investment

Organized Real Estate Markets: Increasing Accessibility

The establishment of organized real estate markets and exchanges facilitated property transactions. The advent of property listings, real estate agencies, and valuation services made real estate investment more accessible and transparent.

Post-War Boom: Residential and Commercial Growth

The period following World War II saw a surge in residential real estate investment, driven by population growth and suburbanization. The construction of single-family homes, apartment buildings, and suburban developments offered lucrative investment opportunities.

Late 20th and Early 21st Century: Globalization and Innovation

In the late 20th and early 21st centuries, real estate investment became a global phenomenon. Influenced by globalization, technological advancements, and innovative investment strategies, modern real estate markets are characterized by greater transparency, advanced financial instruments, and a wide array of investment opportunities.

The history of real estate investing illustrates the enduring importance and value of property ownership. From ancient agricultural practices to contemporary global markets, real estate investment has consistently adapted to meet the changing needs and opportunities of societies.

Authored by Dr. Pooyan Ghamari, Swiss Economist